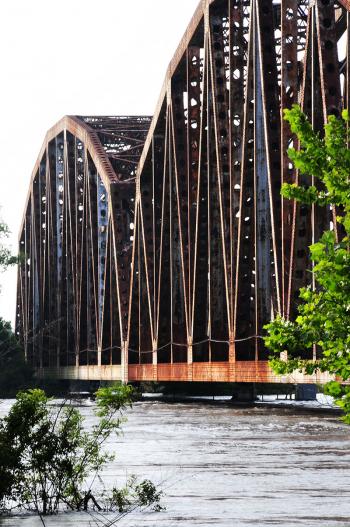

Foodwaters in 2011 nearly lap at the railroad bridge over the Calumet Cut.

(File Photo)

Bill slows rate hikes

After months of a cold shoulder, the U.S. House of Representatives has warmed up to the idea of mitigating the effects of the 2012 Biggert-Waters Act and is proposing legislation that goes further than the Jan. 30 Senate-passed bill that delayed implementation for four years.

The House bill, HR 3370, permanently keeps a grandfather clause protecting homeowners who built to existing codes from drastic rate increases when flood maps or codes change. It also repeals the home sale/new policy rate increase triggers and it provides a retroactive refund to people who paid premium increases when Biggert-Waters went into effect last year. An attempt to sustain the fiscal viability of the National Flood Insurance Program is made with small annual surcharges.

Advocates of Biggert-Waters said the bill was passed to preserve the financial viability of the National Flood Insurance Program that had sustained staggering losses in major storms such as Katrina and Sandy. Those advocates said homeowners, businesses and camp owners should pay actual risk-based rates for flood insurance without federal government subsidies.

Opponents of Biggert-Waters said the rate increases were too steep, would decimate property values and were unfair to people who built their homes to codes existing at the time.

Former Morgan City Mayor Tim Matte has been a leading figure in Morgan City’s struggles with the Federal Emergency Management Agency over the adoption of new flood maps, an even greater issue with the draconian increases in flood insurance premiums following the implementation of Biggert-Waters.

Matte said the House version, which keeps the grandfather clause, meets what area policy makers have said should and needs to be done.

“People who have built, as they were told, under a set of rules should not be penalized,” Matte said. “This is one of the real keys we thought was important.”

Bill Hidalgo Sr., St. Mary Levee District commission president, is encouraged by the House bill.

“I believe this is a move in the right direction,” Hidalgo said. “I firmly believe this is the right thing to do.”

Hidalgo said he understands the need to keep the flood insurance program solvent, but the increases from Biggert-Waters were too much to bear.

“People are going to have to pay their way but it has to be done in a reasonable way without such gross increases in premiums. It needs to be done slowly,” Hidalgo said.

Rep. Bill Cassidy, R-Baton Rouge, was cited by House Majority Leader Eric Cantor, R-Va., as one of two Louisiana congressmen (Steve Scalise, R-New Orleans, was the other) who collaborated with Rep. Michael Grimm, R-N.Y., and other House members around the country in crafting the House legislation.

In a prepared statement, Cassidy said the legislation will help “stabilize our real estate market … Louisiana families facing big flood insurance rate hikes need this legislation.”

Matte said removing the threat of intolerable rate hikes will not change or slow the work being done to enhance and elevate levees around Morgan City.

“But this give us breathing room in making this happen,” Matte said.

Since the Senate passed its bill at the end of January, the Republican majority of the House blocked three votes on the Senate-passed legislation saying there was no provision in the Senate bill to financially stabilize the flood insurance program which carried a debt of about $24 billion.

Cassidy said HR 3370 addresses those concerns. The bill balances flood insurance accessibility and solvency with consumer affordability he said in the statement.

This is done through a small annual assessment dedicated to build up the NFIP reserve fund, which is currently inadequate to handle future storms like Hurricanes Katrina and Sandy, Cassidy said.

Cassidy said the bill includes a $25 annual surcharge on primary residents’ flood insurance policies and about $250 for vacation homes and business properties, until subsidized policies reach full risk rates. Those fees would generate about $1 billion over five years and $2.3 billion over 10 years.

Cassidy explains that the House bill also includes generally accepted affordability measures such as high deductible options, flood protection funding recognition and optional monthly installment plans. The bill lifts the funding cap on the affordability study and accelerates its completion.

U.S. Sen. David Vitter, R-Metairie, announced his support for H.R. 3370, which he describes as stronger than the Senate bill.

“This is a permanent fix, not just a delay, plus it’s completely paid for so the program can sustain itself. The Senate bill was important to get the process going, but the House has strengthened and improved the legislation.” Vitter said.

Differences in the two bills must be resolved in committee. Until then, property owners will have to wait and see what will be done, Matte said. He is optimistic the final version will reflect the provisions found in the House legislation.

If HR 3370 “passes the House, it will be easier to pull the Senate along to make a change than if it had been the other way around,” Matte said.

Louisiana has nearly 500,000 flood insurance policies, and there are more than 5.5 million policyholders nationwide.

- Log in to post comments